In a world where the crypto market is constantly evolving, leveraging the power of Artificial Intelligence can be the key to maximizing your profits. In this listicle, we unveil 7 ingenious ways to harness AI for maximum gains in the cryptocurrency market. From predictive analytics to automated trading strategies, get ready to revolutionize your approach and elevate your profits to new heights. Let’s dive in and discover how AI can transform your crypto investment game.

1) Implement AI-powered trading bots to automate trading decisions and take advantage of market volatility

Implementing AI-powered trading bots is a game-changer when it comes to dominating the crypto market. These advanced algorithms can analyze massive amounts of data in real-time, enabling them to make split-second trading decisions that humans simply cannot match. By leveraging AI, you can take advantage of market volatility and execute trades with precision to maximize your profits.

One key benefit of utilizing AI-powered trading bots is their ability to remove emotions from the trading equation. Emotions such as fear and greed can cloud judgment and lead to poor decision-making, but AI operates purely based on data and algorithms. This results in more rational and strategic trading decisions that are not swayed by human biases. With AI at the helm, you can navigate the ever-changing crypto landscape with confidence and capitalize on opportunities that may otherwise be missed.

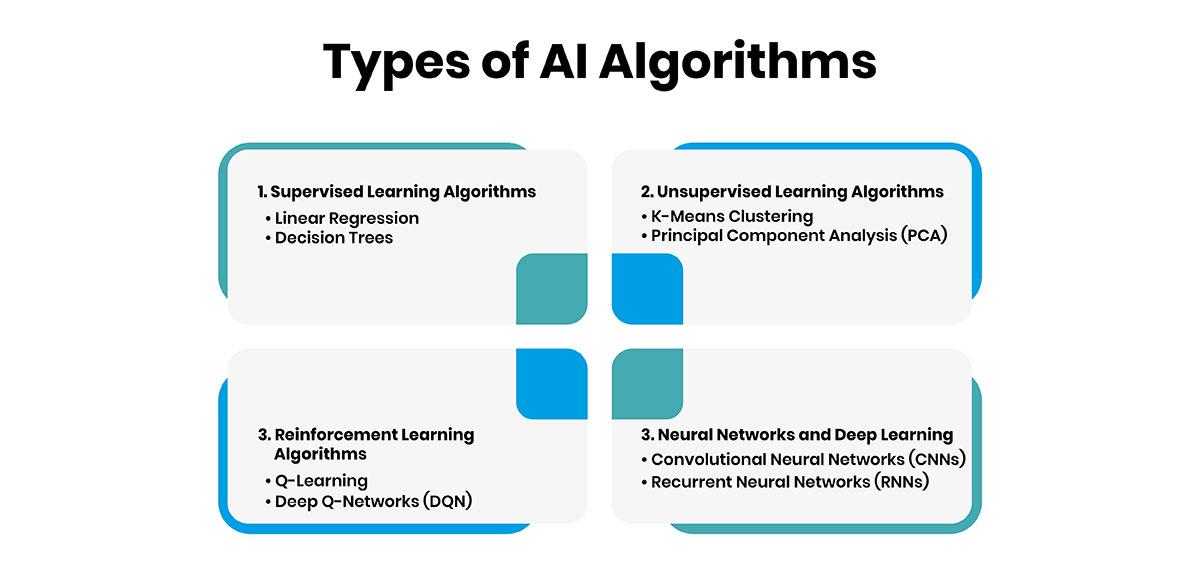

2) Use AI algorithms to analyze historical data and identify patterns that can help predict future market trends

One of the most innovative ways to leverage AI in the crypto market is by utilizing advanced algorithms to analyze historical data. By feeding vast amounts of past market data into AI systems, you can uncover valuable insights and identify patterns that can help predict future trends. This predictive analysis allows you to make more informed investment decisions, maximizing your profits in the volatile world of cryptocurrency.

**Benefits of using AI algorithms for market analysis:**

– Identify emerging market trends before they become mainstream

– Improve risk management strategies by anticipating market fluctuations

– Gain a competitive edge by staying ahead of the curve

3) Utilize machine learning models to optimize your portfolio by identifying the most profitable assets to invest in

One of the most cutting-edge ways to make profitable investments in the crypto market is by leveraging machine learning models to optimize your portfolio. By harnessing the power of AI, you can identify the most promising assets to invest in, maximizing your chances of success. Machine learning algorithms can analyze vast amounts of data to predict future market trends and guide your investment decisions.

These advanced models can help you stay ahead of the curve and make informed choices when it comes to buying and selling cryptocurrencies. By utilizing machine learning, you can capitalize on the volatile nature of the crypto market and make strategic moves that lead to significant profits. With the right algorithms in place, you can navigate the ever-changing landscape of digital assets with confidence and precision.

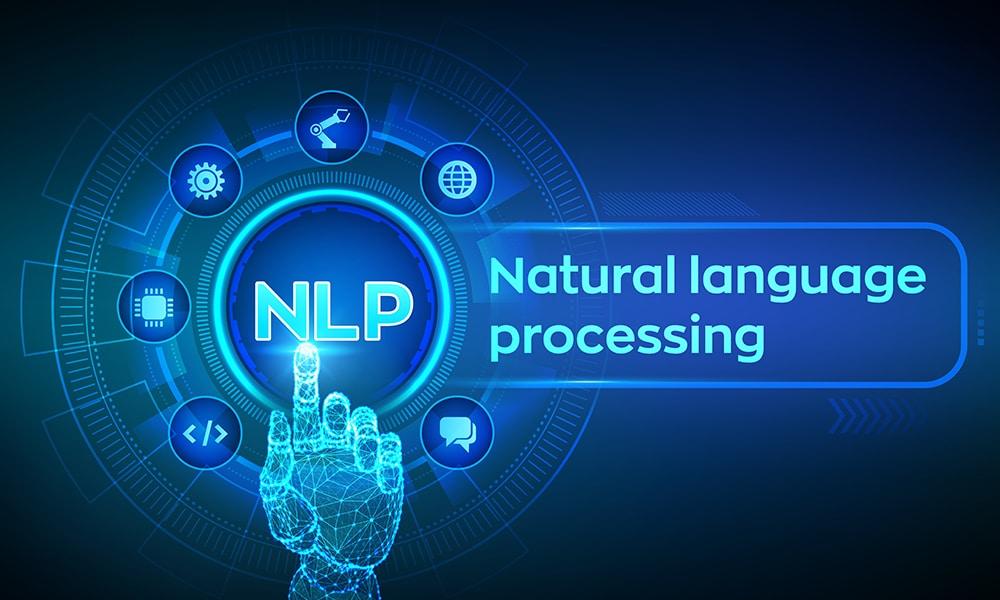

4) Leverage natural language processing to analyze news and social media sentiment, allowing you to make more informed investment decisions

One innovative way to maximize profits in the crypto market is by leveraging natural language processing (NLP) to analyze news and social media sentiment. By utilizing NLP algorithms, you can gain valuable insights into market trends, investor sentiment, and potential price movements. This advanced technology allows you to make more informed investment decisions based on real-time data and predictive analytics.

With NLP, you can track the sentiment of news articles, social media posts, and online forums related to cryptocurrencies. By analyzing the tone and context of words and phrases, NLP can identify patterns and trends that may impact the market. Moreover, NLP can help you stay ahead of the curve by providing actionable insights and alerts on emerging trends or potential risks. By harnessing the power of NLP, you can gain a competitive edge in the crypto market and increase your chances of making profitable trades.

5) Utilize AI-powered risk management tools to minimize potential losses and protect your investments in the volatile crypto market

One way to leverage AI technology in the unpredictable world of cryptocurrency trading is by utilizing AI-powered risk management tools. These advanced tools can help you minimize potential losses and protect your investments in the highly volatile crypto market. By analyzing vast amounts of data in real-time, AI algorithms can quickly detect patterns and trends that human traders might miss, allowing you to make more informed decisions.

Here are some benefits of using AI-powered risk management tools in the crypto market:

-

- Real-time monitoring: AI tools can constantly monitor the market and your investments, alerting you to any potential risks or opportunities.

-

- Automated trading: Some AI tools offer automated trading options based on predetermined risk parameters, allowing you to execute trades quickly and efficiently.

6) Implement AI-powered sentiment analysis tools to gauge market sentiment and make strategic trading decisions accordingly

One of the most powerful tools you can utilize in the crypto market is AI-powered sentiment analysis. By implementing advanced artificial intelligence technology, you can accurately gauge market sentiment and make strategic trading decisions with confidence. These tools are designed to analyze large volumes of data from various sources, such as social media, news articles, and forums, to provide real-time insights into investor sentiment and market trends.

With AI-powered sentiment analysis tools, you can stay ahead of the curve and identify potential market movements before they happen. By understanding the emotions and opinions of investors, you can make informed decisions on when to buy, sell, or hold your assets. This advanced technology can help you optimize your trading strategy and maximize profits in the volatile world of cryptocurrency trading. Embrace the power of AI and take your trading game to the next level!

7) Use AI-powered market prediction models to forecast price movements and make profitable investment decisions in the crypto market

Using AI-powered market prediction models can give you a significant edge in the volatile world of cryptocurrency trading. These advanced systems are able to analyze massive amounts of data in real-time, allowing you to spot trends and patterns that may be invisible to the human eye. By leveraging the power of AI, you can make more informed decisions that can lead to higher profits and reduced risk.

One key benefit of utilizing AI in the crypto market is the ability to forecast price movements with a high degree of accuracy. These sophisticated algorithms can track market indicators, news sentiment, and social media trends to predict how the price of a particular cryptocurrency may change in the near future. By incorporating this predictive data into your investment strategy, you can stay ahead of the curve and capitalize on profitable opportunities as they arise. Enhance your trading game by harnessing the power of AI and unlock the full potential of the crypto market.

To Wrap It Up

As we conclude this list of 7 ingenious ways to harness AI for maximum profits in the crypto market, remember that the world of cryptocurrency is constantly evolving and opportunities for success are always within reach. By incorporating AI technologies into your trading strategy, you can stay ahead of the curve and capitalize on the potential of this dynamic market. Keep exploring, experimenting, and adapting to ensure your continued success in the ever-changing realm of crypto trading. Happy trading!